Salary to hourly calculator with overtime

Your bi-weekly pay is calculated by multiplying your daily or hourly rate times the number of days or hours you are paid. An employees earnings may be determined on a piece-rate salary commission or some other basis but in all cases the overtime pay that is due must be computed on the basis of the regular rate.

Payroll Software Solution Company In India Payroll Software Payroll Solutions

Home financial take-home-paycheck calculator.

. Gross Salary Wages Salaries. Salary to Hourly Calculator. If you do any overtime enter the number of hours you do each month and the rate you get paid at - for example if.

Annual Salary Hourly Wage Hours per workweek 52 weeks. You can enter regular overtime and an additional hourly rate if you work a second job. Visit to see yearly monthly weekly and daily pay tables and graphs.

Use our United States Salary Tax calculator to determine how much tax will be paid on your annual Salary. Hourly wage 2500 Daily wage 20000 Scenario 1. This calculator assumes a work week consists of 40 hours and a work day consists of 8 hours.

For example if a worker has an hourly rate of 1050 and works 40 hours in a given week then their wages for that period would be 40 x 1050 or 420. Semi-Monthly Salary Annual Salary 24. The salary calculator will also give you information on your daily weekly and monthly earnings.

An employee receives a hourly wage of 15 and he works 40 hours per week which will result in the following earnings. Therefore overtime pay is not included in these calculations. Based on a 40 hours work-week your hourly rate will be 1068 with your 27000 salary.

2022 Salary Paycheck Calculator Usage Instructions. This only affects hourly rate and overtime calculations. New York employers including many large retailers that pay their hourly employees on a bi-weekly or semi-monthly basis may be violating the New York Labor Law that requires manual workers be paid weekly within seven calendar days of the end of the week in which their wages were earned.

Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the US. The regular rate is the average hourly rate calculated by dividing the total pay for employment except the statutory exclusions in any workweek by. Explore the cost of living and working in various locations.

Weekly salary 60000. The overtime hours are calculated as 15 standard hourly rate but can vary depending on the circumstance eg. The salary calculator will also give you information on your weekly income and monthly totals.

Your overtime multiplier overtime hours worked and tax rate to figure out what your overtime hourly rate is and what your paycheck will be after income taxes are deducted. Calculate hourly and premium rates that could apply if you are paid overtime If you are paid on an hourly or daily basis the annual salary calculation does not apply to you. To use the pro-rata salary calculator enter the full-time annual salary in the Full-time Salary box and the number of weekly hours that are considered full-time into the Full-time weekly hours box.

You can factor in paid vacation time and holidays to figure out the total number of working days in a year. Easily convert hourly wage or pay rate to salary. DOL is increasing the standard salary level thats currently 455 per week to 684 per week.

Find out what you should earn with a customized salary estimate and negotiate pay with confidence. Companies can back a salary into an hourly wage. You may also want to factor in overtime pay and the effects of any.

Cost of Living Calculator. Our hourly to salary calculator converts an hourly wage to annual salary or the other way around. Use this calculator to easily convert a salary to an hourly rate and the corresponding daily wage monthly or weekly salaryUse it to estimate what hourly rate you need to get to a given salary yearly monthly weekly etc in other words calculate how much is X a year as a per hour wage.

So if the example worker from above would have an additional 10 overtime hours their salary will be. In our example it gives 14hour 15 21hour. 14hour 120 hours 21hour 10 overtime hours.

If you earn 27000 a year then after your taxes and national insurance you will take home 22202 a year or 1850 per month as a net salary. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Monthly Salary Annual Salary 12.

Hourly employees are compensated at a set hourly rate which is multiplied by the hours worked during any given pay period. Use our salary conversion calculator. Working on Christmas Day.

Inform your career path by finding your customized salary. See where that hard-earned money goes - with UK income tax National Insurance student loan and pension deductions. If youre paid an hourly wage of 18 per hour your annual salary will equate to 37440 your monthly salary will be 3120 and your weekly pay will be 720.

Includes tips bonus and overtime pay of 40268 based on 525 salaries. This calculator uses the 2019 withholding schedules rules and. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay.

For instance if a grocery store hires cashiers for an hourly rate of 1500 per hour on a full-time schedule of 40 hours a week you can calculate the annual pre-tax salary by multiplying the hourly rate by 40. Information provided on this site is for illustrative. Particularly when comparing annual salary to hourly salary or trying to determine commission and benefits.

Enter your hourly wage and hours worked per week to see your monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. The formula of calculating annual salary and hourly wage is as follow. Then multiply the product by the number of weeks in a year 52.

An early career Graphic Designer with 1-4 years of experience earns an average total. Cost of Living Calculator. Overtime Calculator Usage Instructions.

Quarterly Salary Annual Salary 4. According to the Fair Labor Standards Act FLSA non-exempt employees that are covered must receive overtime pay for hours. Overtime rate applies to any hours worked over 40 in a week Results.

A project manager is getting an hourly rate of 25 while working 8 hours per day and 5 days a week. Weekly Salary Daily Salary Days per workweek. And how much you are paid.

The latest budget information from April 2022 is used to show you exactly what you need to know. Pay for Hourly Employees. Calculate your value based on your work experience and skill set.

Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs. Federal tax State tax medicare as well as social security tax allowances are all taken into account and are kept up to date with 202223 rates. Determine the annual cost of raising an hourly rate or how hourly workers overhead business expenses on an annual basis.

Claims for compensation due to the late payment of wages. Biweekly Salary Annual Salary 26. His income will be.

Hourly rates weekly pay and bonuses are also catered for. These figures are pre-tax and based on working 40 hours per week for 52 weeks of the year with no overtime. Remember that a full salary with benefits can include health insurance and retirement benefits that add more value to your total annual salary compared to similar hourly rates.

Payroll Template Free Employee Payroll Template For Excel Payroll Template Payroll Spreadsheet Template

Building Maintenance Checklist Templates 7 Free Docs Xlsx Pdf Maintenance Checklist Checklist Template Checklist

What Is Annual Income How To Calculate Your Salary

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Calculator

Python Program Wage Calculator Python Programming Computer Programming Python

Python Program Wage Calculator Python Programming Computer Programming Python

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Payroll Checks

Calculating Your Paycheck Salary Worksheet 1 Answer Key Fill Out And Sign Printable Pdf Template Signnow Paycheck Teaching Math Printable Signs

Pin Page

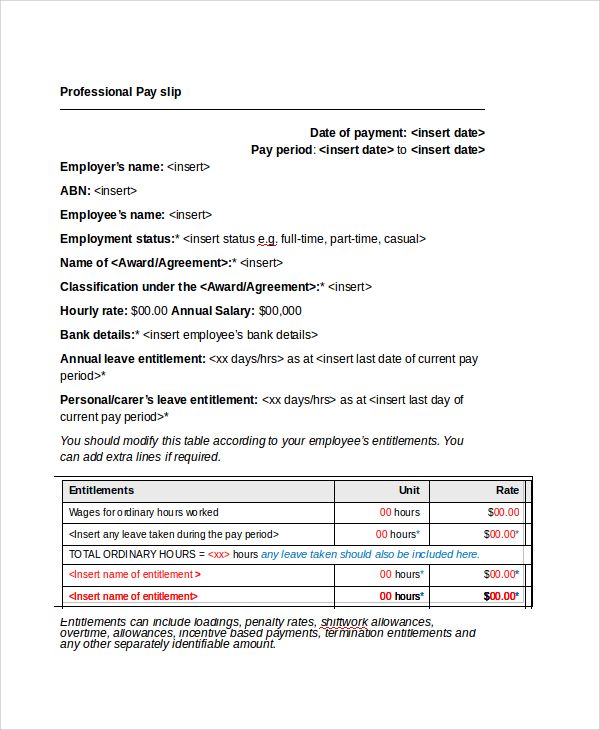

Payslip Templates 28 Free Printable Excel Word Formats Templates Words Word Template

Payslip Templates 28 Free Printable Excel Word Formats Templates Words Repayment

Employee Training Schedule Template Excel Elegant Yearly Training Plan Template Excel Free Weekly Schedule Excel Templates Excel Calendar Employee Training

Payroll Software Company In Chandigarh Employee Management Payroll Software Payroll

Pin Page

Calculating Your Paycheck Salary Worksheet 1 Answer Key Fill Out And Sign Printable Pdf Template Signnow Paycheck Teaching Math Printable Signs

Google Sheets Video 1 Add Subtract Multiply Divide Average And Sum Youtube Subtraction Google Sheets Ads

Pay Stub Calculator Templates 13 Free Docs Xlsx Pdf Payroll Template Spreadsheet Template Life Planning Printables